When a brand-name drug loses its patent, the first generic version usually hits the market at about 15% of the original price. That sounds like a win-until you realize that’s still too expensive for many people. The real price collapse doesn’t happen with the first generic. It happens when the second and third generics arrive.

Why the Second Generic Is a Game-Changer

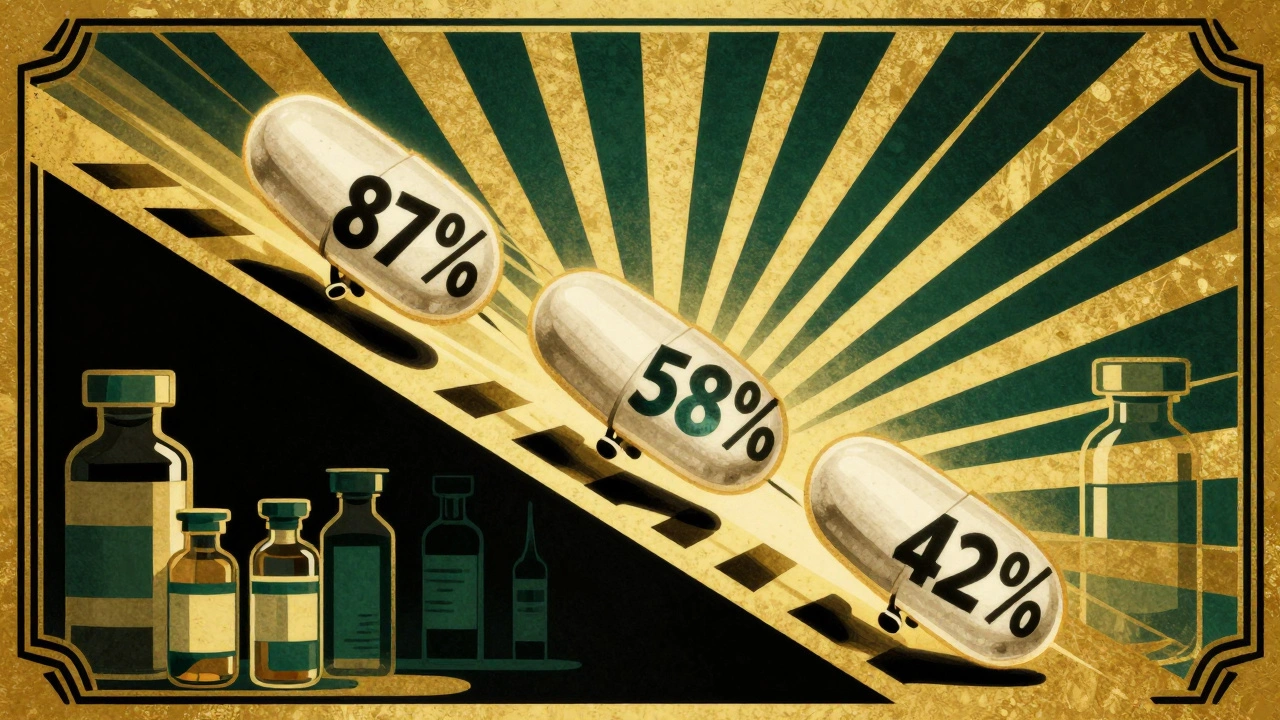

The first generic maker gets a head start. They’re the only option, so they can charge a bit more-sometimes as much as 87% of the brand’s original price. But that changes fast. Once a second company gets FDA approval and starts selling the same drug, prices drop sharply. According to FDA data from 2022, the second generic brings prices down to about 58% of the brand’s cost. That’s a 31% drop in just a few months. This isn’t random. It’s basic economics. When there’s only one seller, they control the price. But add one more, and suddenly they’re racing to undercut each other. Pharmacies and insurers start playing them against each other. The second company doesn’t want to lose market share, so they slash prices. The first company has to follow-or lose everything.The Third Generic Triggers a Price Crash

The third generic doesn’t just lower prices further. It triggers a collapse. FDA analysis shows that when a third manufacturer enters, prices fall to just 42% of the brand’s original price. That’s a 16-point drop from the second generic alone. In some cases, prices drop even more-sometimes below 30%. Why does this happen? Because now there are three companies fighting for the same customers. The third entrant needs to make a splash. They’ll offer the lowest price possible, even if it means thin margins. The first two have no choice but to match it. The result? A race to the bottom-and patients win. A 2021 analysis by the Assistant Secretary for Planning and Evaluation (ASPE) found that markets with three or more generic manufacturers saw price reductions of about 20% within three years. That might sound small, but when you’re talking about a drug that costs $1,000 a month, 20% is $200. Multiply that by millions of prescriptions, and you’re talking billions in savings.What Happens When Only Two Companies Compete?

Here’s the scary part: nearly half of all generic drug markets have only two manufacturers. That’s called a duopoly. And in a duopoly, prices don’t always drop. They can even rise. A 2017 study from the University of Florida found that when competition dropped from three companies to two, prices jumped 100% to 300% in some cases. Why? Because with only two players, they can subtly coordinate-not by talking, but by watching each other. If one raises prices, the other follows. No one wants to be the first to cut, because then they lose revenue. The result? Stagnant or rising prices, even though the drug is generic. This is why the entry of a third competitor is so critical. It breaks the silent agreement. It forces transparency. It turns a cozy duopoly into a chaotic, price-cutting free-for-all-and that’s exactly what patients need.

Why Don’t More Companies Enter?

If third generics save so much money, why aren’t there always three or more? One reason is manufacturing. Making generic drugs isn’t easy. It requires strict FDA compliance, complex supply chains, and expensive equipment. Smaller companies often can’t afford the upfront cost. That’s why a handful of big players-like Teva, Viatris, and Mylan-dominate the market. After mergers and acquisitions, the number of independent generic manufacturers has shrunk. Another reason? Brand companies fight back. They file dozens of patents on a single drug-sometimes 50, 75, even 100-to delay generics. This is called “patent thicketing.” One drug had 75 patents that extended its monopoly from 2016 to 2034. That’s not innovation. That’s legal obstruction. Even worse, some brand companies pay generic makers to stay out of the market. These “pay-for-delay” deals cost patients and taxpayers nearly $12 billion a year, according to the Blue Cross Blue Shield Association. In one case, a brand company paid a generic maker $100 million to delay its entry for a year. That’s $100 million in extra costs for patients who needed the drug.Who Benefits from More Competition?

Patients, obviously. But so do insurers, pharmacies, and even the government. The FDA estimates that the 2,400 new generic drugs approved between 2018 and 2020 saved consumers $265 billion. That’s not a guess. That’s based on actual sales data and price tracking. Most of those savings came from the second and third entrants. Pharmacy Benefit Managers (PBMs) like Express Scripts get better deals when there are more generic options. The more choices they have, the more leverage they have to negotiate discounts. Hospitals and group purchasing organizations also benefit-they can switch suppliers if one raises prices. Even Medicare and Medicaid save billions. The Congressional Budget Office warns that without more generic competition, Medicare could lose $25 billion annually by 2030. That’s money that could go to care, not corporate profits.

What’s Being Done to Fix This?

There are signs of progress. The 2022 CREATES Act stops brand companies from blocking generic makers from getting samples they need to test their drugs. That’s a big deal-without samples, you can’t prove your generic works the same way. The Preserve Access to Affordable Generics and Biosimilars Act targets “pay-for-delay” deals. If passed, it would make these secret payments illegal. The FDA’s GDUFA III program, running from 2023 to 2027, is pushing faster approvals for complex generics-drugs that are harder to copy, like inhalers or injectables. These used to take years to enter the market. Now, the FDA is prioritizing them. But the real fix is simple: encourage more manufacturers to enter the market. More entrants mean more competition. More competition means lower prices. And lower prices mean more people can afford their medicine.What You Can Do

If you’re paying for prescriptions, ask your pharmacist: “Is there another generic version of this drug?” If they say no, ask why. If the answer is “only one company makes it,” you’re in a duopoly-and you’re overpaying. Talk to your doctor. Ask if there’s a therapeutically equivalent drug with more generic competition. Sometimes, switching to a different drug in the same class can save you hundreds a month. Support policies that promote generic competition. Contact your representative. Ask them to support bills that ban pay-for-delay deals and speed up generic approvals. The system works when there’s real competition. The second and third generics aren’t just alternatives-they’re the reason millions of Americans can afford their medicine today. Without them, prices wouldn’t just be higher. They’d be unaffordable.Why do generic drug prices drop so much after the second and third companies enter?

When only one generic company sells a drug, they face little pressure to lower prices. But when a second company enters, they compete for market share by cutting prices. A third company pushes prices even lower because now all three are fighting to win contracts with pharmacies and insurers. This competition drives prices down to as low as 40% of the original brand cost.

Can generic drug prices go up even after generics are available?

Yes, if competition drops. If a third generic manufacturer exits the market or fails to enter, the remaining companies may raise prices. Studies show that when a market shifts from three competitors to two, prices can jump 100% to 300%. This happens because there’s no longer pressure to undercut each other.

Why aren’t there always three or more generic makers for every drug?

Manufacturing generics requires FDA approval, expensive equipment, and strict quality control. Many smaller companies can’t afford the upfront cost. Big companies have merged, reducing competition. Brand manufacturers also use tactics like patent thickets and pay-for-delay deals to block new entrants.

Do generic drugs work the same as brand-name drugs?

Yes. The FDA requires generic drugs to have the same active ingredient, strength, dosage form, and route of administration as the brand. They must also prove they’re absorbed in the body at the same rate and extent. Generic drugs are not inferior-they’re just cheaper.

How much money has generic competition saved patients?

Between 2018 and 2020, new generic drugs saved U.S. consumers $265 billion, according to the FDA. Most of those savings came from the entry of second and third generic manufacturers. Without that competition, prices would still be near brand levels for many medications.

lol i just asked my pharmacist for another generic and they looked at me like i asked for a unicorn 🦄. turns out only one company makes my blood pressure med. i’m paying $120 a month for something that should cost $15. this post hit hard.

AMERICA IS GETTING ROBBED. these pharma giants are laughing all the way to the bank while normal people skip doses. third generic? more like third chance to not die. wake up sheeple.

the economics here are textbook but the real issue is market concentration. when you have oligopolistic structures in essential goods like pharmaceuticals, price elasticity becomes irrelevant. the barrier to entry isn't just capital-it's regulatory capture. FDA approval delays, patent thickets, and pay-for-delay agreements aren't bugs-they're features of the system.

they’re lying. the government lets this happen so they can control us. you think this is about money? it’s about power. they want you dependent.

In India, we see this every day-multiple generics for the same drug, priced at pennies. I remember buying metformin for less than 10 cents per tablet. The moment competition enters, the market corrects itself. It’s not magic. It’s capitalism, properly applied. Why can’t the US embrace this?

i had no idea the third generic was the magic number. my dad’s cholesterol med dropped from $80 to $12 after another company showed up. mind blown.

This is why we need systemic reform. Every time a third generic enters the market, it’s not just a price drop-it’s a moral victory. We’re talking about lives here. People choosing between insulin and groceries. We must push for policy changes that prioritize health over profit.

sooo… if you’re paying more than $20 for a generic, you’re being scammed. period. 🚩

The structural barriers to entry-regulatory, financial, and legal-are deeply embedded in the pharmaceutical supply chain. The FDA’s GDUFA III is a step, but without breaking up the vertical integration of PBMs and manufacturers, we’re just rearranging deck chairs on the Titanic. The real leverage lies in public procurement power.

I’ve been watching this play out for over a decade. When I worked in hospital pharmacy, we’d switch between generics based on which one had the best contract that month. But the moment a third option appeared, the price would just… evaporate. It was like watching a balloon deflate. The system works when there’s real competition. The problem is we’ve been conditioned to accept monopolies as normal.

bro this is the most underrated economic story of our time. imagine if your phone charger cost $100 because only one company made it… but then two more showed up and suddenly it’s $5. that’s what’s happening with meds. we just don’t notice because we’re too busy paying.

The regulatory framework governing generic drug approval must be restructured to prioritize market entry velocity over procedural perfection. The current paradigm incentivizes delay, not dissemination. Legislative intervention is required to dismantle the pay-for-delay ecosystem and enforce transparency in supply chain dynamics.

why do americans always complain? in my country, we just take what we get. if you can’t afford medicine, you shouldn’t be sick. stop being weak.

i don't even read this stuff anymore. too much work. just give me my pills and shut up.