When a new drug hits the market, it doesn’t just rely on patents to keep competitors away. In fact, many drugs enjoy years of market control without any patent at all. This is where regulatory exclusivity comes in - a powerful, government-backed shield that blocks generics and biosimilars from entering the market, even if the patent has expired. It’s not about who invented what. It’s about who got approved first - and the rules that come with it.

What Exactly Is Regulatory Exclusivity?

Regulatory exclusivity is a time-limited period granted by health agencies like the FDA after a drug is approved. During this window, other companies can’t even submit applications to sell generic or biosimilar versions. It’s automatic. No lawsuits. No patent filings. Just a clock that starts ticking the moment the FDA says yes.

Think of it this way: patents protect inventions - a specific chemical structure, a new delivery method, a unique formulation. Regulatory exclusivity protects the drug itself. If you’re the first to prove a drug is safe and effective for a condition, the government says: ‘You’ve earned the right to be the only one selling it for X years.’

This system was built to fix a real problem. Back in the 1980s, drug companies were spending 10-15 years developing new medicines. By the time they got approval, many patents had already expired. They’d spent billions - and had zero market time. The Hatch-Waxman Act of 1984 changed that. It created a trade-off: faster generic access in exchange for guaranteed exclusivity for innovators.

The Four Main Types of Exclusivity in the U.S.

Not all exclusivity is the same. The FDA grants different types based on the drug’s characteristics. Here’s what you’ll actually see in practice:

- New Chemical Entity (NCE) Exclusivity - 5 years: This is the gold standard for small-molecule drugs. If the active ingredient has never been approved before, the FDA won’t accept any generic application for four years. And won’t approve one until five years have passed. That’s why brand-name drugs like Lipitor or Nexium had a full five-year head start.

- Orphan Drug Exclusivity - 7 years: For drugs treating rare diseases affecting fewer than 200,000 people in the U.S. The catch? You have to prove the disease is truly rare at approval. Drugs like Spinraza (for spinal muscular atrophy) and Vyvanse (originally for ADHD, later expanded) used this to lock in market control. Even if patents expire, generics can’t touch it for seven years.

- 3-Year Exclusivity: This kicks in when a company submits new clinical data to add a new use, dosage, or formulation to an already-approved drug. For example, if a diabetes drug gets approved for heart failure after a new trial, the original maker gets three extra years of protection for that new indication.

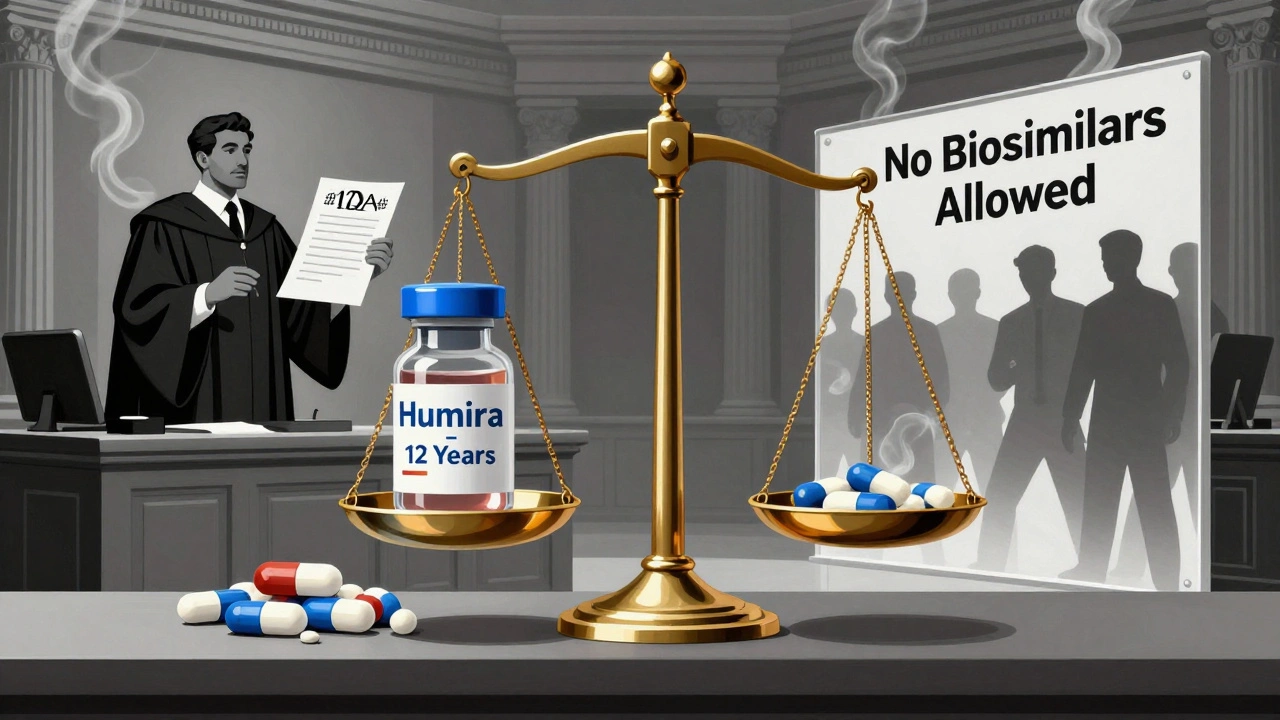

- Biologics Exclusivity - 12 years: This is the big one. Biologics - complex drugs made from living cells, like Humira, Enbrel, or Keytruda - get 12 years of exclusivity under the BPCIA of 2009. No generics. Not even biosimilars. The FDA can’t approve them until the clock runs out. This is why Humira still had zero competition in the U.S. until 2023, even though its main patent expired in 2016.

These periods don’t always start at the same time. A drug can have 5-year NCE exclusivity, 7-year orphan exclusivity, and 12-year biologics exclusivity - and they can stack. The longest one wins. That’s why some drugs enjoy over a decade of market control.

How It Works in Europe and Other Regions

The U.S. isn’t the only player. The EU uses a different system: the “8+2+1” rule.

- 8 years of data exclusivity: Generic makers can’t use the originator’s clinical trial data to support their application.

- 2 years of market exclusivity: Even if they’ve built their own data, they can’t sell their product yet.

- 1 extra year: If the drug gets a new approved indication during that time, the clock extends.

Japan gives 10 years of data exclusivity for new chemical entities. Canada and Australia have similar but shorter terms - usually 5-8 years.

These differences matter. A drug approved in the U.S. might face biosimilars in Europe years before it does at home. Companies plan global launches around these timelines. A biologic with 12-year U.S. exclusivity might get hit by generics in Germany after just 10 years.

Regulatory Exclusivity vs. Patents: Key Differences

It’s easy to confuse these two. Here’s how they’re not the same:

| Feature | Regulatory Exclusivity | Patent Protection |

|---|---|---|

| Who grants it? | Health agencies (FDA, EMA) | Patent offices (USPTO, EPO) |

| When does it start? | Upon FDA approval | Upon patent filing (often years before approval) |

| How long does it last? | Fixed: 5, 7, 12 years depending on type | 20 years from filing, but often reduced by approval delays |

| Can it be challenged? | No. It’s automatic if criteria are met. | Yes. Litigation is common. Patents get invalidated. |

| What does it protect? | The drug product itself | A specific invention (formula, method, use) |

| Can competitors bypass it? | Only by making a different drug - not a copy | Yes. Design around the patent |

Here’s the kicker: patents can be knocked down in court. Regulatory exclusivity can’t. If you’re a drugmaker, you’d rather have 12 years of guaranteed exclusivity than a 20-year patent that gets challenged on day one.

Why It Matters: The Economic Impact

Regulatory exclusivity isn’t just legal jargon. It’s a multi-billion-dollar lever.

Drugs under exclusivity sell for 3.2 times the price of generics, according to IQVIA. In 2023, Pfizer made over $52 billion from exclusivity-protected products. AbbVie’s Humira brought in $19.9 billion in U.S. sales in 2022 - all while waiting for biosimilars to finally arrive.

And it’s growing. Between 2018 and 2023, 88% of new drugs approved by the FDA qualified for at least one type of exclusivity. Orphan drugs now make up nearly half of all novel approvals - up from 18% in 2010. Companies are gaming the system. They’re filing for orphan status even for common conditions, if the patient pool in the U.S. dips below 200,000.

But there’s a flip side. Public Citizen and other consumer groups argue that these protections drive up drug prices and delay affordable access. The 12-year biologics term, in particular, is under fire. The EU is pushing to cut data exclusivity from 8 to 6 years. In the U.S., bills like H.R. 3013 tried to shorten biologics exclusivity to 10 years - but lobbying blocked them.

Real-World Strategy: How Companies Use It

Big pharma doesn’t just wait for exclusivity - they engineer it.

Take Humira again. AbbVie didn’t rely on one patent. They filed over 100. But even that wasn’t enough. The real shield? The 12-year biologics exclusivity. It gave them a legal wall that courts couldn’t touch. When the first biosimilar finally launched in 2023, AbbVie had already made over $170 billion in sales.

Smaller companies use orphan exclusivity as a lifeline. A startup developing a drug for a rare genetic disorder might not have the budget for massive trials. But if they can prove the disease affects fewer than 200,000 people, they get 7 years of market control - and a shot at pricing power.

Generic companies hate this. On Reddit, a generic developer wrote: “We spend millions developing a drug, then wait 4 years just to submit. The FDA won’t even look at it until the exclusivity ends. It’s a gamble.”

That’s why top pharma firms hire dedicated exclusivity managers. These specialists track expiration dates across global markets, file paperwork months in advance, and coordinate with legal teams to avoid overlap mistakes. One mistake - missing a deadline or misclassifying a drug - can cost millions.

The Future: Pressure and Change

Regulatory exclusivity isn’t static. It’s under pressure.

The FDA’s 2024 Drug Competition Action Plan says it wants to “modernize exclusivity frameworks.” That’s code for: we need to balance innovation with access.

Experts predict the average combined patent and exclusivity period will drop from 12.3 years to 10.8 years by 2030. Biologics may keep their 12-year term - but not forever. The EU’s proposed overhaul could set a global precedent. If data exclusivity shrinks to 6 years in Europe, U.S. companies will feel the pressure to follow.

One thing won’t change: exclusivity will stay a core part of drug development. Without it, companies wouldn’t risk billions on drugs for rare diseases. But if it lasts too long, patients pay the price.

The line between incentive and monopoly is thin. Right now, regulators are trying to walk it.

How to Know If a Drug Has Exclusivity

If you’re a patient, pharmacist, or investor, how do you check?

- Look up the drug in the FDA’s Purple Book. It lists exclusivity status for biologics and small molecules.

- Check the FDA’s approval letter - it usually mentions exclusivity type and duration.

- For U.S. drugs, the Orange Book lists patents - but not exclusivity. You need both.

- For international drugs, check EMA’s EU Public Register or Japan’s PMDA database.

Don’t assume a drug is off-patent just because the patent expired. If it still has exclusivity, generics can’t enter - even if the patent is gone.

so like… if a drug gets orphan status just because it helps 199k people, is that really ‘rare’ or just a loophole? 🤔 i mean, 199k is still a LOT of people needing help, but the company gets 7 years of monopoly? feels sketchy

Regulatory exclusivity serves as a necessary incentive for pharmaceutical innovation particularly in niche therapeutic areas where research costs are disproportionate to market size

OMG i just realized why my insulin is still $500 even though it’s been around for 100 years?? 🥲 like the patent expired but the exclusivity clock is still ticking?? that’s wild. i thought it was just greedy pharma but now i see it’s like… government-sanctioned price gouging 😭

so if you get 12 years for biologics but the patent expires at 7… that means 5 whole years of no competition even if the science is public? that’s not protection thats a lock

Let me break this down for you like you’re five. Patents are like your secret recipe. Exclusivity is the government saying ‘nobody else can even look at your recipe for 12 years, even if they figure it out on their own.’ So if you’re a biologic? Congrats, you get to be the only one selling Humira until 2028 even if every lab in the world knows how to make it. That’s not innovation. That’s legal cartels. And yes, I’ve read the FDA’s purple book. Twice. You’re welcome.

so the ‘orphan drug’ loophole is basically ‘make a drug for a disease so rare that only rich people get it, then charge $800k per dose’? genius. i bet the 200k threshold was chosen by someone who’s never met someone who actually has spinal muscular atrophy. also… why does the FDA even let this happen? oh right. lobbying. again.

It is evident that the current framework of regulatory exclusivity, while ostensibly designed to incentivize innovation, has evolved into a mechanism that unduly prolongs market monopolies at the expense of public health equity. The absence of meaningful recalibration constitutes a systemic failure.

For anyone wondering how to check if a drug still has exclusivity: don’t just look at the patent expiration date. Go straight to the FDA’s Purple Book - it’s free, public, and tells you exactly when generics can legally enter. I’ve seen pharmacists get this wrong all the time. If you’re a patient, knowing this could save you hundreds. If you’re an investor, it’s your edge. Knowledge is power - and in pharma, it’s also profit.